Mutual Fund

We have all the mutual fund schemes on offer by virtually all theAsset Management Companies (AMCs) in the country. As a client, you can access any scheme with us, either in physical mode or even in a demat /stock-exchange mode with Trading Account services

Fixed Income

We also offer clients with diverse fixed income products, namely

Non-Convertible Debentures (NCDs), Infrastructure and RBI Bonds, Company Deposits, etc. from some of the leading companies, institutions in India..

Capital Market

Capital markets are the financial exchanges, which exist so that companies and governments in need of cash to operate or expand can sell assets to investors with money to lend or invest. The stock, bond, and commodities markets are among the best-known capital markets.

Life Insurance

Life insurance' is a contract between the policy holder and the insurer, where the insurer agrees to pay a designated beneficiary a sum of money upon the occurrence of the insured individual's or individuals' death or other event, such as terminal illness or critical illness. In return, the policy holder agrees to pay a premium - stipulated amounts at regular intervals or in lump sum.

Portfolio Management Services

We offer Portfolio Management Services (PMS) strategies with direct equity and mutual funds as the underlying products from the leading PMS providers in India. Some of our PMS strategies are exclusive in the market which can only be subscribed through us.

Health Insurance

Health insurance is a type of insurance whereby the insurer pays the medical costs of the insured if the insured becomes sick or injured due to covered causes, or due to accidents. The insurer may be a private insurance company or a government agency.

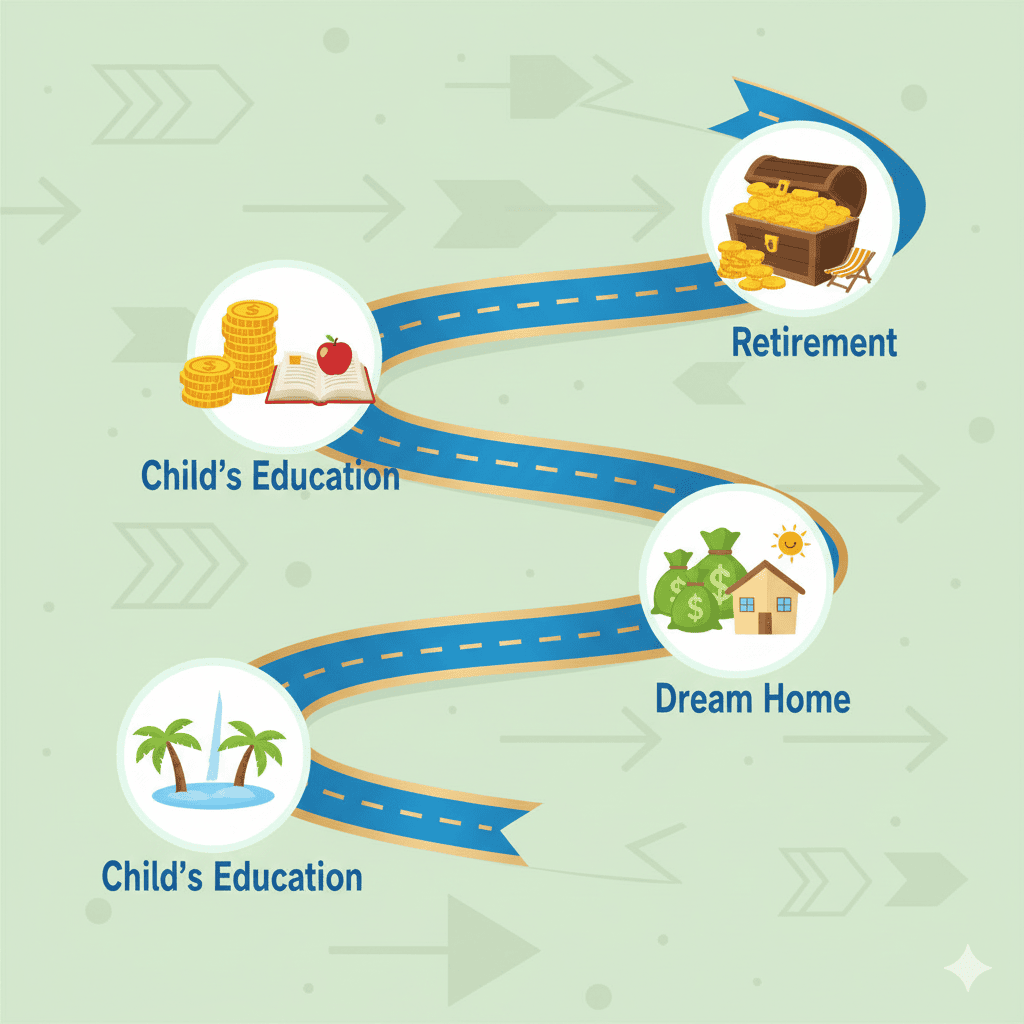

Investment Planning

Most of our investment is also lying around without any purpose or target or any objective.Thus, most of us do not have goals and even if the goals are there in mind, they are rarely properly planned. Proper planning requires very little time or even expertise, however, it can prove to be very critical.

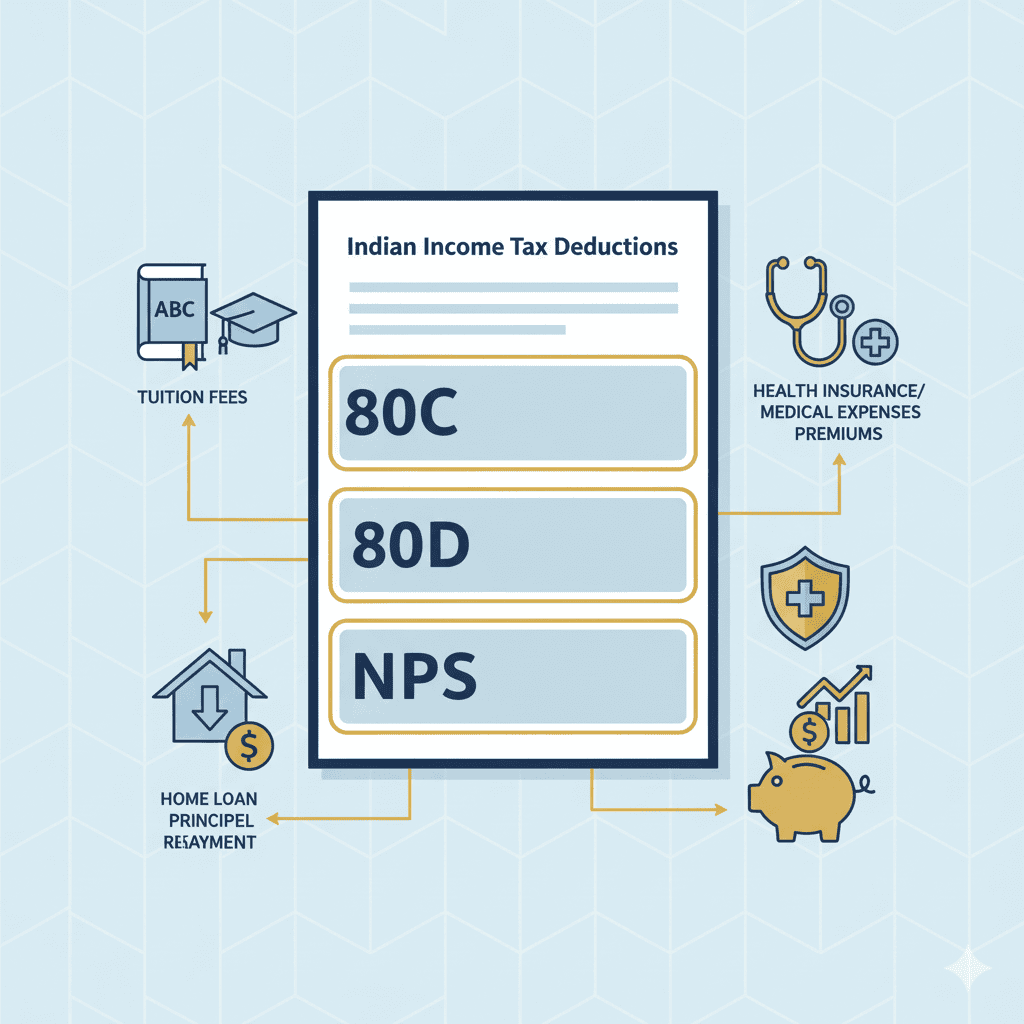

Tax Planning

Tax planning is best done early rather than waiting until March for last-minute decisions. It begins with assessing your gross income and taxable liability, followed by using deductions under sections like 80C, 80D, and NPS to reduce taxes. The key is to choose investments wisely so that they not only save tax but also align with your long-term financial goals, ensuring both savings and growth.

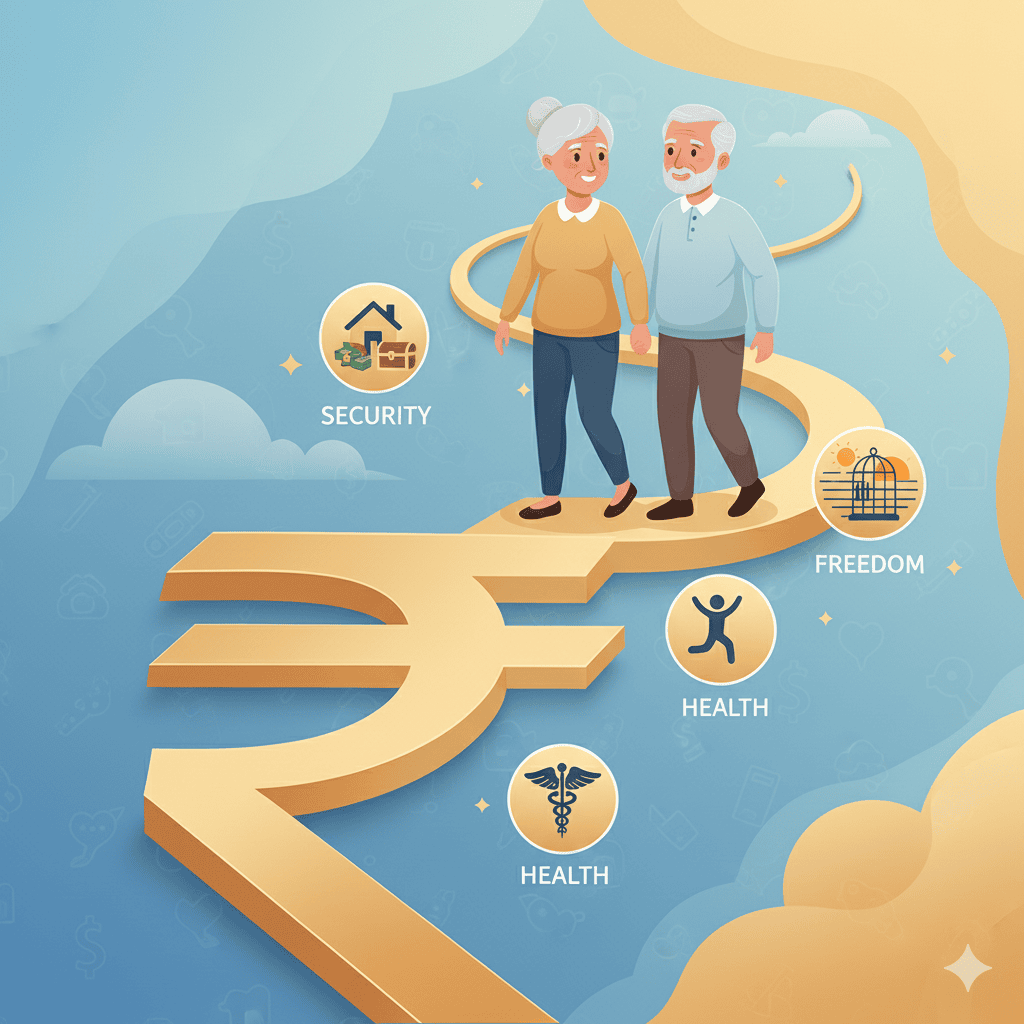

Retirement Planning

Retirement is not the end of investing—it’s the beginning of a new financial journey. Once you have your retirement corpus, the focus should be on managing it wisely so that it lasts through your lifetime. Prioritize paying off debts, building an emergency fund, and choosing the right mix of equity and debt to secure steady income while protecting your savings. Proper retirement planning ensures peace of mind, financial stability, and the freedom to enjoy life after work.

Monthly Statements

We regularly update our clients on new investment opportunities.

This ensures they can make informed decisions at the right time.

Our goal is to help maximize benefits through timely investments.

By staying informed, clients can optimize their portfolio for growth and security.

We aim to guide every investor toward smarter, well-timed financial choices.

This ensures they can make informed decisions at the right time.

Our goal is to help maximize benefits through timely investments.

By staying informed, clients can optimize their portfolio for growth and security.

We aim to guide every investor toward smarter, well-timed financial choices.

Estate Planning

We provide expert estate planning services to help secure your legacy.

Our guidance ensures your assets are distributed according to your wishes.

We help minimize taxes and legal complexities for your heirs.

With proper planning, you can protect your family’s financial future with confidence.

Portfolio Analysis

One of the most valuable services we offer is online monitoring and portfolio analysis. With secure credentials, you can access your account anytime, anywhere to track the performance of your investments, analyze your portfolio, and review all details with complete ease and convenience.

Motor Insurance

Motor insurance (also known as vehicle / car / auto insurance) is insurance purchased for cars, trucks, and other road vehicles. Its primary objective is to provide protection against physical damage resulting from traffic collisions and against liability that could also arise there-from.